Why Insurance Carriers & TPAs Need Automated Redaction to Speed Up Claims

by Zain Noor, Last updated: December 1, 2025, ref:

The insurance industry is undergoing a significant digital transformation. Remote adjusters, cloud-based claim systems, mobile claims submission, and video evidence are becoming the new standard. Yet, despite these advancements, one operational burden continues to slow down claim cycles: manual redaction of personally identifiable information (PII).

Every claim file includes sensitive data names, addresses, phone numbers, license plates, emails, financial information, and insurance teams must ensure this information is hidden before sharing or storing documents. Manual redaction is time-consuming, inconsistent, and risky.

This is why more insurance carriers and TPAs are turning to automated, AI-powered redaction that works across documents, images, and even videos, and importantly, works seamlessly on Mac devices often used by adjusters and field teams.

The Growing Redaction Challenge in Insurance Claims

Insurance organizations handle an enormous volume of unstructured information daily. A single claim may include:- Policyholder and claimant documents

- Photos of the incident

- Repair bills and estimates

- Emails or letters

- Police reports

- Site inspection videos

- Customer-submitted mobile recording

Each of these documents includes PII that must be redacted before:

- Sharing with external vendors

- Sending to legal, underwriting, or compliance teams

- Uploading into long-term storage systems

- Using for training, quality checks, or audits

- Regulatory fines under GDPR, CCPA, state privacy laws

- Data leakage is impacting sensitive personal information

- Increased legal liability for mishandled claim information

- Loss of policyholder trust

- Delays in claims processing

The problem intensifies when adjusters handle dozens of claims at once. Redacting even a simple PDF can take several minutes and doing this repeatedly across multiple claims results in lost hours each week.

Automation eliminates these inefficiencies while improving accuracy and compliance.

Why Automated Redaction Is Transforming the Claims Process

1. Dramatically Cut Manual Effort for Adjusters

Adjusters often juggle large caseloads and struggle to keep up with the administrative overhead. Automated redaction can identify and redact PII instantly from:- PDFs

- Word files

- Emails

- Handwritten documents

- Scanned images

- Photos

- Dashcam, surveillance, and mobile videos

- Close claims faster

- Reduce burnout

- Improve accuracy and productivity

- Focus on investigation, customer communication, and settlement

2. Reduce Human Error and Compliance Risk

Manual redaction is prone to:- Missed PII

- Inconsistent formatting

- Incorrect masking

- Unintentional data exposure

- High-accuracy detection of PII across file types

- Consistent redaction rules are applied every time

- Automatic detection of patterns like phone numbers, emails, and addresses

- Audit trails showing exactly what was redacted

This minimizes the chance of a privacy breach or regulatory violation.

3. Support for Mac Users and Remote Adjusting Teams

Many modern adjusters especially in insurtech and TPA environments, work on MacBooks or personal devices. They need tools that are:- Browser-based

- Lightweight

- Secure

- Cloud-accessible

- Platform-independent

A cloud redaction platform removes IT friction:

- No software installation

- Works on Mac, Windows, tablets

- Secure SSO-based access

- Easy scaling to 50–500 users

Perfect for distributed operations and flexible staffing models.

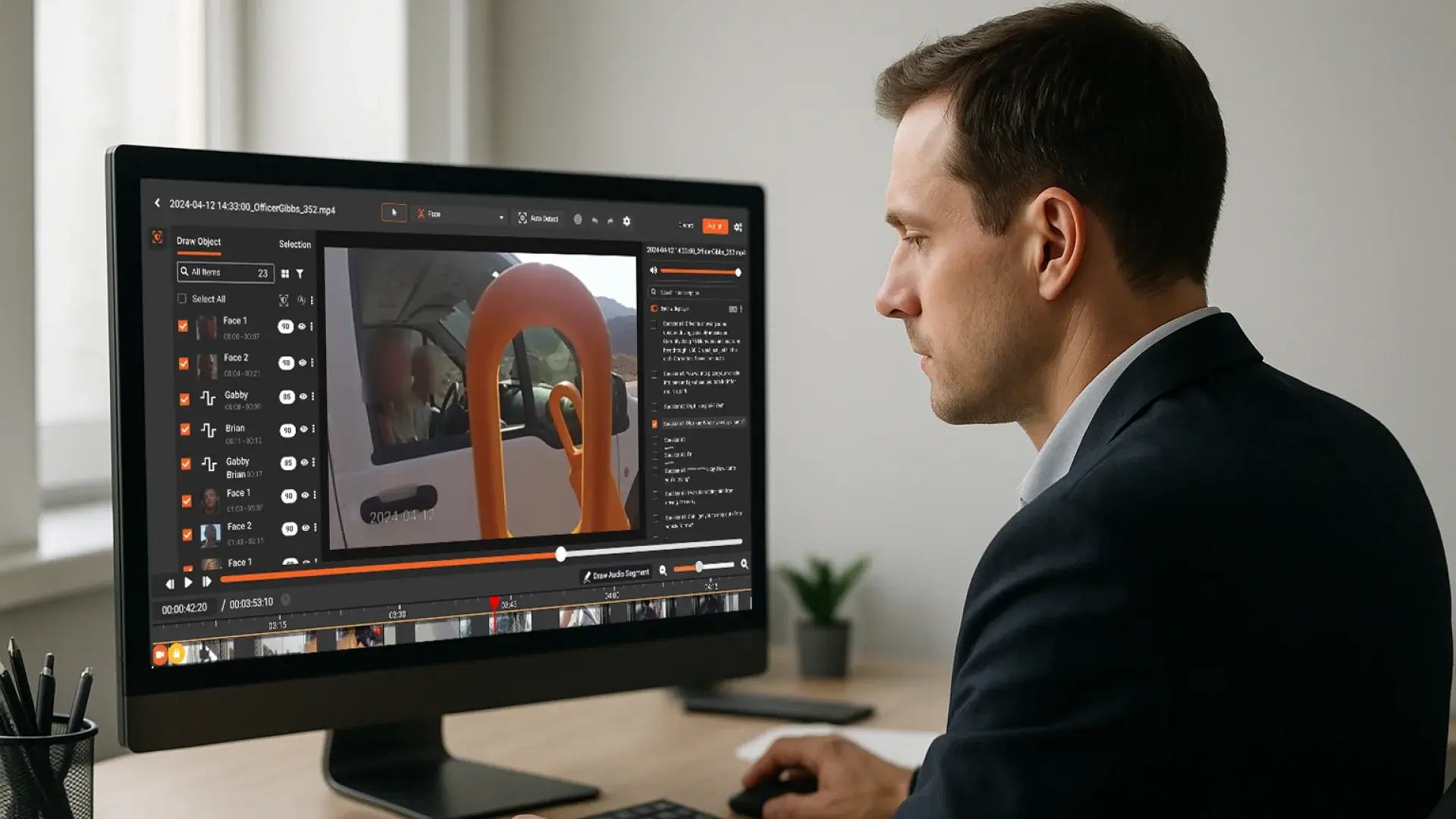

4. Accurate Video Redaction for Modern Claims

Insurance claims now frequently include video evidence, such as:- Walk-through property inspections

- Auto accident recordings

- Drone footage

- Bodycams

- Residential camera footage

- Contractor videos

- License plates

- People’s faces

- House numbers

- Street signs

- Sensitive objects like IDs or paperwork captured in frame

Object tracking ensures the system follows the object even as it moves, saving hours of editing time.

How VIDIZMO’s Redaction Platform Helps Insurance Organizations

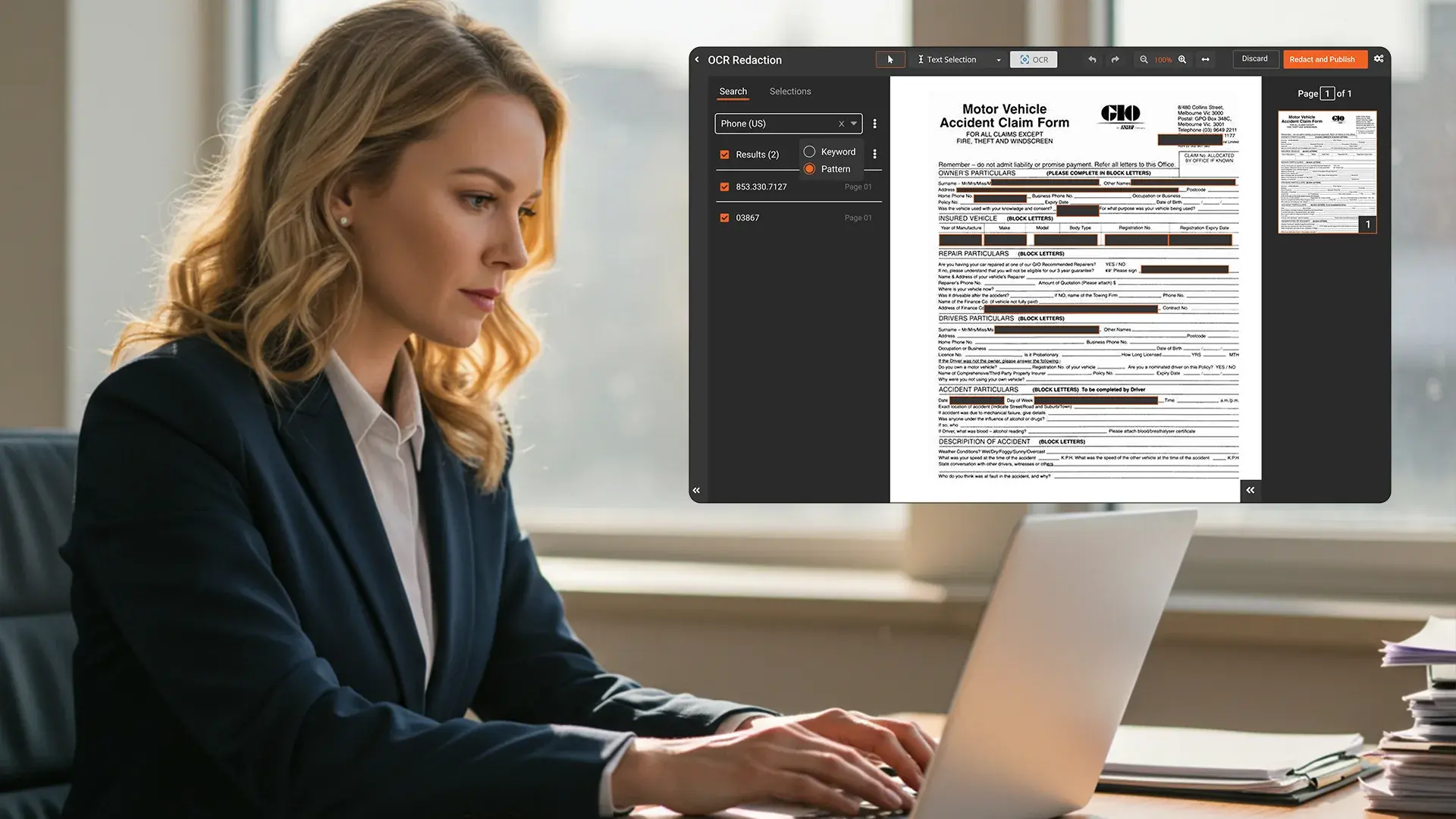

VIDIZMO Redactor provides a complete redaction solution designed for insurers and TPAs:Comprehensive PII Detection

Detects and redacts:

- Addresses

- Emails

- Phone numbers

- Social Security numbers

- License plates

- Driver information

- Case numbers

- Financial PII

- Faces and moving objects in videos

Redacts Documents in Minutes

Documents can be processed in seconds to minuteseven large batches allowing adjusters to quickly move files between departments.Advanced Video Redaction

- AI object tracking

- Face detection

- ID masking

- License plate recognition

- Scene-by-scene redaction capability

- SSO integration (Okta, Azure AD, etc.)

- Role-based access

- User-specific repositories

- Multi-department separation

- Audit logs for compliance

VIDIZMO supports:

- Manual upload workflows

- API-based integration

- Automated file ingestion

- Return of redacted files to claims portals

This allows insurers to adopt a fast phase 1 (manual workflows) and later upgrade to full integration.

Real Business Impact for Insurers

Implementing automated redaction yields measurable results:- 60–80% reduction in time spent on redaction

- 40–70% faster claims processing

- Significant reduction in privacy-related risks

- Improved adjuster productivity and job satisfaction

- More consistent compliance and quality checks

Insurers gain both operational efficiency and stronger regulatory protection.

Conclusion

Manual redaction is a hidden operational burden that slows claim resolution and increases privacy risk. Automated AI-powered redaction is no longer a luxury—it’s a necessity for modern insurance carriers and TPAs facing rising document volume, strict compliance requirements, and expanding digital evidence.Platforms like VIDIZMO Redactor help organizations:

- Move faster

- Stay compliant

- Support Mac-based adjuster teams

- Scale securely

- Reduce operational costs

- Provide better customer experiences

The future of claims processing is automated, and insurers adopting AI redaction today will lead the industry tomorrow.

Start your Free Trial today - No Credit Card Needed

Jump to

You May Also Like

These Related Stories

Unattended Video Redaction at Scale for Compliance Workflows

.webp)

How UK Schools Can Handle SARs Faster with Automated Redaction

.webp)

No Comments Yet

Let us know what you think